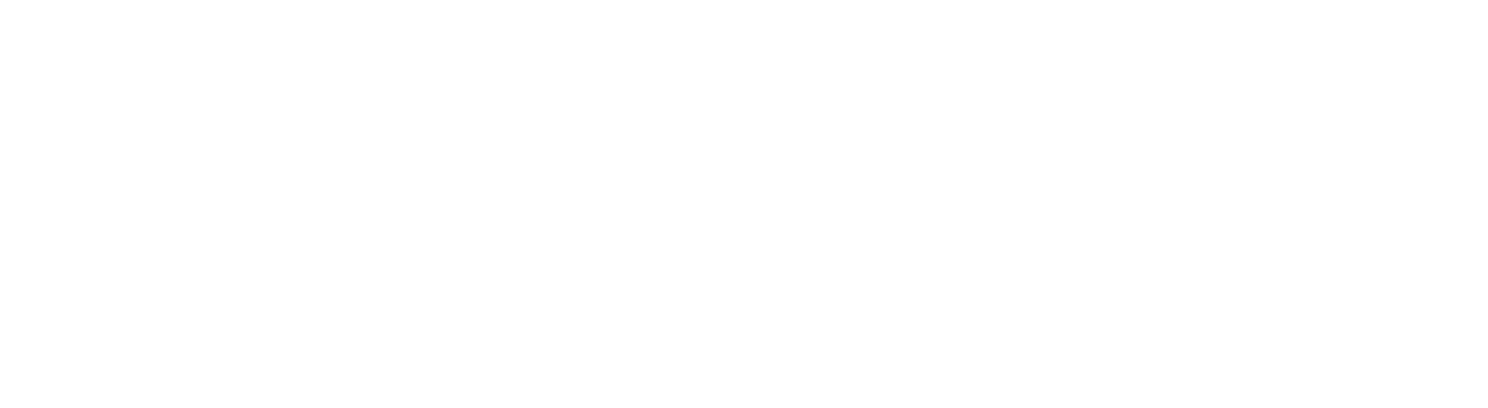

In Q3 2024 the Xeneta and Marine Benchmark Carbon Emissions Index (CEI) has reached a record high, caused by the Red Sea crisis, freight rates and global supply chains congestion.

The CEI has hit 107.9 points as of Q3 2024, a 12.2% year-on-year increase that demonstrates the severe impact of the Red Sea crisis on the carbon emissions that produced by container shipping.

The index takes Q1 2018 as its baseline carbon emissions measurement, with readings over 100 indicating carbon emissions per tonne of cargo are above levels from that period.

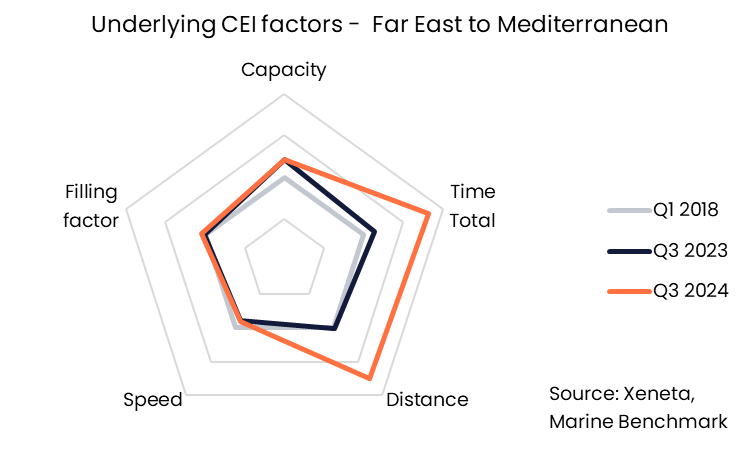

In Xeneta’s analysis, the CEI reveals the large difference in emissions between those trades that are or are not impacted by the Red Sea crisis. The biggest year-on-year increase was evident in Far East to Mediterranean trade, for which the CEI score is up 60.1%, while the backhaul is up 46.3%.

It is also noted that, despite not transiting the Red Sea and Suez Canal, trade from North Europe to South America East Coast has seen a greater than 30% year-on-year increase in Q3 2024.

The five trades with lower year-on-year CEI scores are only found in those that are not affected by the Red Sea crisis and therefore are not required to sail around Africa.

In terms of the quarter-on-quarter differential (Q2-Q3 2024), the biggest increases were 40.3% from the US West Coast to Far East, and 19.7% from the US East Coast to North Europe.

The deterioration of the Transatlantic backhaul is explained in part by the 1250-TEU decrease in the average capacity of ships that are deployed on this route, with smaller ships being less efficient from a carbon intensity perspective than larger vessels.

Another reason cited for increased emissions on backhaul trades is the increased average speed of carriers that are rushing to meet ever-more demanding schedules. From North Europe to the Far East, the average sailing speed rose to 16.2 knots in Q3, the highest it has been since for two years.

Xeneta’s Emily Stausbøll writes: “This is an example of how reducing carbon emissions falls down the priority list at times of increasing congestion, tightening capacity and spiralling freight rates. When shippers are scrambling to secure capacity and carriers are financially incentivized to provide it, carbon reduction is not front of mind for either party.”

Backhaul and fronthaul routes between the Far East and Mediterranean were the worst performing trades and reveal the severe impact of the Red Sea crisis on carbon emissions.

The below chart illustrates the year-on-year differences in sailing distance and transit time on trade between the Far East and Mediterranean. Several factors have been deployed to reduce carbon emissions, such as a slightly lower sailing speed in Q3 2024 vs Q3 2023 and an increase in average ship size and filling factor.

Despite these factors, all of which help lower carbon emissions, they are not enough to compensate for the impact of the diversion around the Cape of Good Hope.

Source: Xeneta